What is relationship mapping?

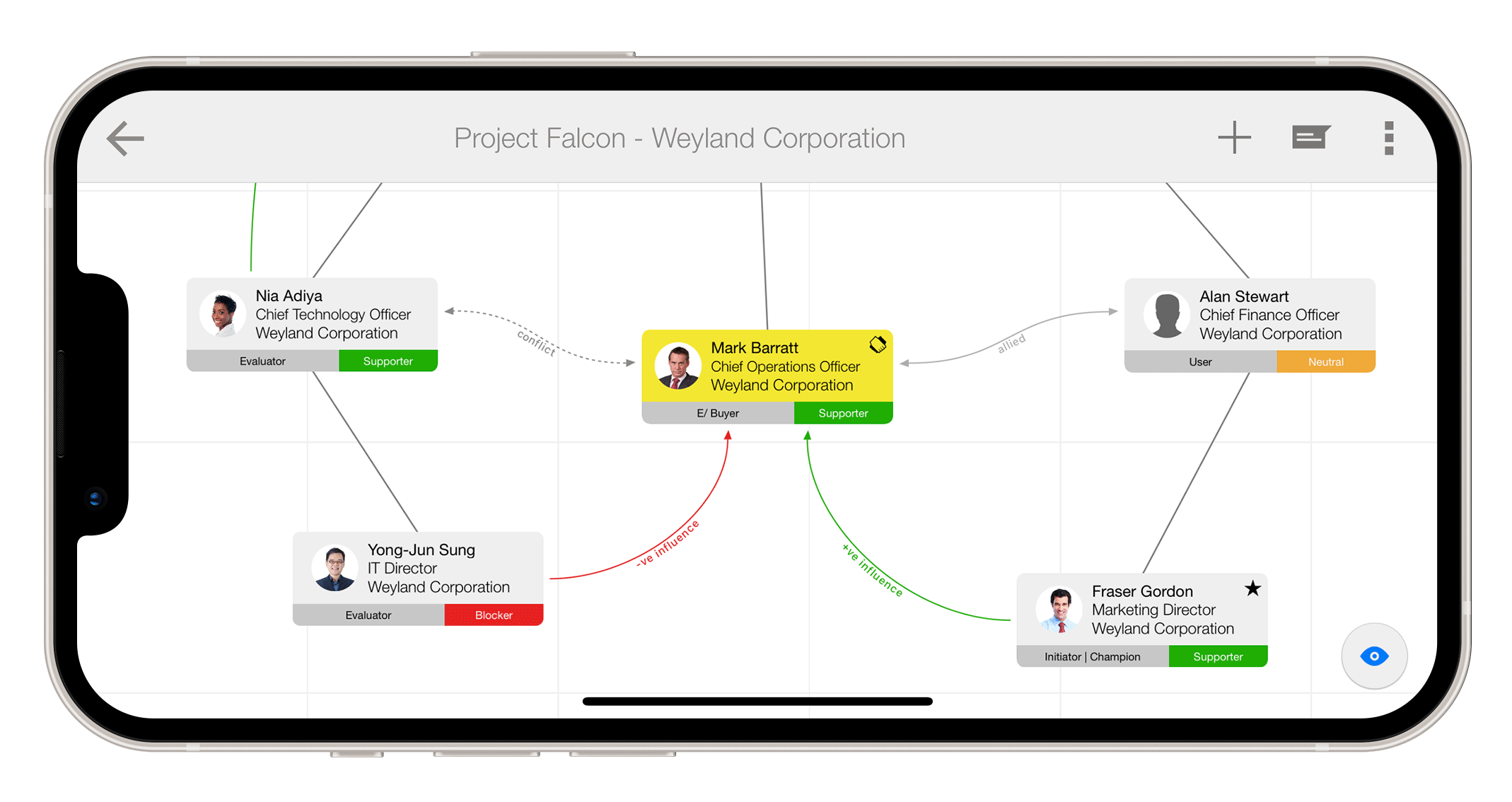

Relationship mapping involves the creation of a visual chart depicting the stakeholders, roles, motivations and biases within a project. Different symbols, colour codes and lines are used to indicate relationship types, strengths and directions.

Relationship maps are visual illustrations that shows a broad view of the interactive relationships between the stakeholders of a project, committee or negotiation. Alternative names for a relationship map include organisational context diagram, business interaction model, entity relationship diagram and organisational relationship map.

Download ContactBase to build an org chart today!

Relationship mapping use-cases

Relationship maps are used in several areas across the enterprise:

Sales – Relationship mapping helps sales executives, account executives and business development managers win new commercial opportunities as well as grow or protect existing business. As research tell us, an average of 7 people will be involved in an B2B purchasing decision. With the increase in decision-makers, the complexity of making the sale increases. Relationship maps are most valuable in complex projects or negotiations which involve a lot of influencers.

Customer Success – As well as sales, customer success managers use relationship maps when starting a new role or adopting a new set of customer accounts. Relationship mapping can also be used to train and coach new customer success or renewals managers on the complexity of a typical deal, by demonstrating the inner workings of a customer’s buying committee.

Business Consultants – Business consultants hired to improve the position of a business often use relationship maps when proposing changes to an organisation’s structure including hiring new management or merging with other organisations. Relationship maps help highlight standout individuals with the greatest power and influence.

Project Managers – Current-state and future-state relationship maps are used by project managers to manage the scope of a project as it transitions from its initial owners to a permanent team.

Business Leaders – Relationship maps are used to help business leaders or owners understand areas of over-staffing with an organisation, to enable a more efficient distribution of resources. Org charts are heavily utilised following mergers and acquisitions.

Why relationship mapping?

1 – Unlike org charts, relationship maps take into account individuals outside of your customers organisation such as consultants that often have vast levels of influence. Relationship maps illustrate the formal hierarchical powers within an organisation, as well as the invisible influential powers that often shift the balance in the big decisions.

2 – Large enterprise deals are often complex involving multiple stakeholders. Relationship mapping between decision-makers, evaluators, budget holders and influencers can help you think more strategically about your approach. A relationship map can help you identify the most probable-to-convert points within the target account.

3 – Mapping out a complicated deal will help salespeople uncover blockers and gatekeepers. Relationship mapping helps you decide on the best strategy to pursue e.g. navigate past and go wider or bridge build to turn into advocate. Relationship mapping can help you identify the exact sequence of people to target to get the most out of your deal.

4 – Creating a customer relationship map can help you communicate a deal to your sales manager. The visual representation will help your manager understand who reports to who and who influences who within a buying center. Relationship mapping your key accounts will form a summarised view of actionable data for sales mentoring and planning.

5 – According to the Corporate Board, seven people on average participate in the average B2B purchase decision. You can, no longer rely on the strength of a single relationship to ensure a decision goes your way. Relationship mapping is a powerful tool in the decision-by-committee era.

What are the limitations?

1 – Creating a relationship map in the traditional sense i.e. manually can be time consuming. Before the political mapping can begin, discovery and mapping of hierarchy reporting lines and job titles needs to be plotted.

2 – Relationship maps are out-of-date as soon as they are created as political relationships change over time and individuals leave organisations and join different projects. Using specialist relationship mapping solutions like ContactBase can alleviate this problem.

3 – Relationship maps are subjective. In other words, they often only capture the view of a single or small number of individuals.

4 – Portability is often a challenge as relationship maps can be stored on a central server.

The mapping process

Step 1: Establish and prioritise your own interests – Work out your own interests – not party demands or positions. Work out what you want from the negotiation. These interests should include your needs, concerns and notions of success. The more an agreement meets your interests, the more valuable it is to you. After you’ve worked out your interests, you should prioritise them.

Interests can be classified into three major categories:

- Short-term Interests e.g: only affect the next 2-3 months

- Mid-term Interests e.g: impacts the next year

- Long-term Interests e.g: systemic long-term goals of 3 years or more

Your interests could be as simple as renewing an existing contract, or as complex as replacing a customers business critical system with a new solution.

Finally you should identify any tensions among these interests and prioritise them, which will help bring clarity and flexibility as you negotiate.

Step 2: Identify the relevant players – List out all relevant players, so that no individual that will be affected by the outcome of the negotiation is left out. In larger negotiations, use team leaders to represent departments or groups of interests. To list all affected does not necessarily mean that they are influential players, only that consideration of them is relevant when negotiations are conducted. The relevancy of the individual is measured subjectively by the party doing the mapping i.e. you. By clarifying your interests in Step 1 you can better define the relevant players.

Step 3: Identify key players interests – After listing all the relevant players, it is time to analyse them. As you established your interests in Step 1, you should now do the same for each player listing out key needs, concerns, and notions of success based on what you currently know about them and others in a similar position. It is important to beware of assumptions based on cultural stereotypes and generalisations. Take some time to realign your interests and priorities to other players.

Step 4: Identify the relationships between players – Now you know who the relevant players are, and what each player wants from the agreement, you need to identify and analyse all existing relationships between the parties.

Professor James Sebenius of Harvard Business School classifies three types of relationship:

- Deference – This is the relationship pattern where Player A will most likely do whatever Player B thinks of or announces. This could be due to hierarchical authority or the knowledge that Player B is a subject matter expert. Each form of deference carries different weights and must be treated differently.

- Influence -This is the relationship pattern where Player A is likely to follow Player B’s lead, or do what Player B advises or directs Player A to do. Influence can be due to many reasons e.g. best intentions, a trust of judgment, or a common interests.

- Antagonism – This is relationship pattern where Player A will not follow Player B’s lead or do what Player B advises or directs Player A to do. The reason for antagonism could be due to past indifferences or conflicting interests.

Identifying alliances within the client organisation can be extremely useful. This will give you an idea of whom to bring in, and whom to leave out of your negotiation efforts.

Step 5: Plan and implement – Now that you have determined who is relevant for your negotiation and where each parties interests sit, you can start to identify the relationships among the parties. Start with mapping hierarchies, then explore the alliances, influences and conflicts. Finally, plot these relationships on the map to visually understand the complexity of the structure of relationships.

Step 6: Attack the map – After you’ve drawn out your map, it’s time to take action!

There are 3 core strategies that you can employ for this:

- Backward Mapping – In this strategy, identify the decision-makers first. Then identify the person to whom that player defers. Continue the process until you identify a player who you can influence easily, or have a good relationship with. Pay attention not only to individual relationship patterns but also to the joint value that an alliance might have on influencing the final decision-making process.

- Bootstrapping – In this strategy, you start with ‘easier’ players before moving to the ‘harder’ players. The ‘easier’ players are usually your natural allies or people that defer to you for guidance. The ‘harder’ players are the ones you cannot influence easily or need greater support. The idea is to start small and keep building up support for your cause. Be sure to exploit your personal and professional relationships.

- Pyramiding – In this strategy, you do the opposite of bootstrapping. You begin with the players who are the hardest to influence, who are typically the most senior and hard to reach. Often these players exert the most influence within the organisation. If successfully executed, this strategy move the dial the fasted, as you bypass influencers and move swiftly to a decision.

Step 7: Maintain the map – As the owner of the relationship map, its your job to ensure that it stays up-to-date. Conduct a monthly or quarterly review to ensure the credibility of data.